EPFO ATM Withdrawal Limit: The government is also seriously considering linking the Digital Wallet with EPFO in which the processed claim amount will be deposited and the subscribers will be able to withdraw it easily.

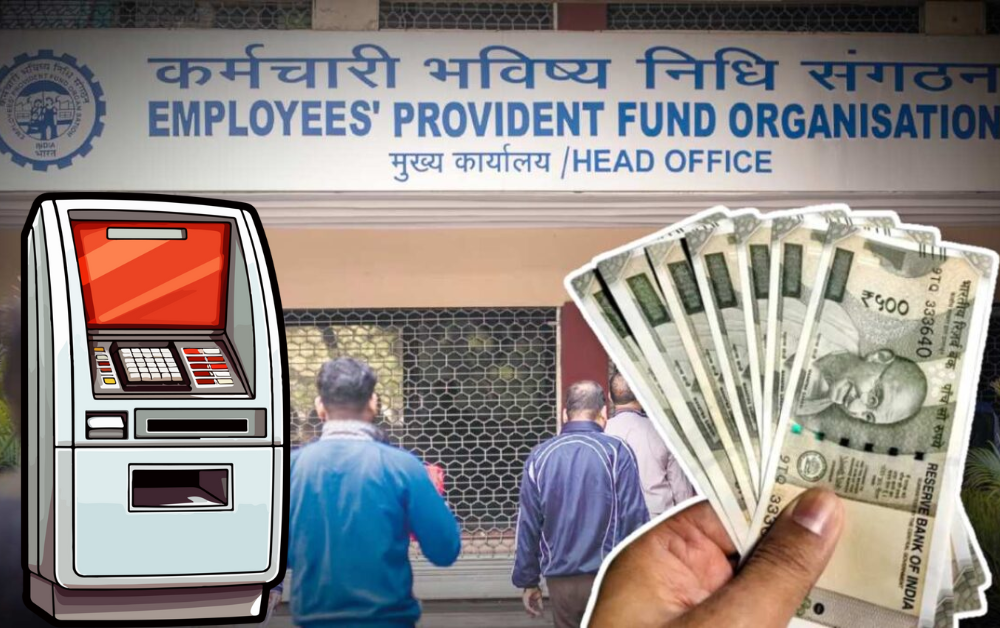

Provident Fund ATM Withdrawal Rules: The dream of withdrawing hard-earned money deposited in Provident Fund from ATM is going to come true in the new year 2025. The central government is preparing to launch this scheme in the early months of the new year. To prepare a roadmap for this, the Ministry of Labor and Employment will soon discuss with the banking sector regulator Reserve Bank of India (RBI) and the country’s leading banks. The government’s aim is to promote ease of living for the 7 crore subscribers of EPFO. Not only this, the government is also seriously considering linking the digital wallet with EPFO, in which the processed claim amount will be deposited and the subscribers will be able to withdraw it easily.

PF claim will be processed soon

The central government wants to improve the digital infrastructure of the Employees Provident Fund Organization. Before allowing the withdrawal of Provident Fund money from ATM, the government will revamp the digital infrastructure of EPFO and only after that the scheme will be launched. The Labor Ministry wants to speed up the approval system along with reducing the processing time of Provident Fund claims so that the problems faced by the subscribers can be reduced. However, even after allowing the withdrawal of Provident Fund money from ATM, the amount can be withdrawn only after getting approval from EPFO as per the existing rules.

There will be a limit on withdrawing PF money from ATM

The approval process for withdrawing money from Provident Fund will be automated, along with this the interference of EPFO office will be reduced. The ministry has not yet decided the limit for withdrawing Provident Fund money. But it is certain that a limit will be fixed for withdrawing money from ATM. However, no final decision has been taken yet to allow withdrawal of only 50 percent of the total PF balance from ATM.

Digital wallet will be linked with EPFO

The government is also seriously considering linking digital wallet with EPFO in which the processed claim amount will be deposited and withdrawn. However, no decision has been taken on this and RBI’s advice will be taken regarding this.

Technology will simplify the claim process

Due to the software upgrade of EPFO, there has been a 30 percent increase in the claim process of subscribers in August-September. The government is going to make the new EPFO Information Technology System 2.01 operational in the next two months. This will speed up the claim process even more. In the new system, the claim settlement system will be centralized. Which includes auto processing of claims, centralized monthly pension disbursement, universal account number based EPF accounting. In the new system, the rules for transfer of member ID on changing jobs can also be abolished.